The global gamification market is valued at almost $12 billion in 2021. Much of it is fueled by advertising and marketing campaigns spread across major industries – and the world of banking/finance is not lagging. Financial organizations are increasingly moving their banking products online, and in the day and age of increased competition, and waning user interest, more companies are using gamification techniques to boost customer engagement levels. Introducing mini-games, trivia, wheel-of-fortune-style instant rewards, and above all, a tiered privilege program to enhance user loyalty – all hallmarks of gamification – are being leveraged to inject new life into this domain.

What is Banking Gamification?

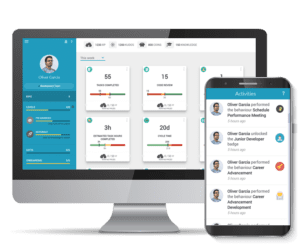

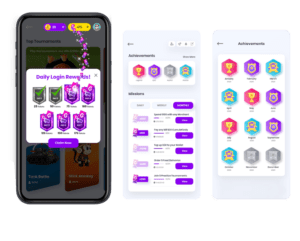

Banking gamification, at its most basic, is the process of transforming day-to-day banking processes into milestone-based task and rewards type activities, often by incorporating gameplay mechanics from video games. By mimicking the interactivity and immersion of playing a video game, gamification in banking and finance increases customer engagement, boosts their interest in, and knowledge of, banking products and services, as well as makes the entire experience enjoyable. Rewards associated with these activities provide a sense of instant gratification. Some banks add social collaboration, integration with other apps, and more to further increase their brand value and awareness.

What are the Benefits of Gamification in Banking?

Here are some benefits that banking gamification can bring to the table:

- Increased customer engagement, awareness, and retention: Gamified finance and banking apps are more interactive, immersive, and customer-focused, designed to give the customer the feeling of playing a game. This unique combination is a powerful way to engage users and retain them. Gamification techniques can be used to increase product and service awareness among customers as well (tutorial videos that can be viewed to earn points, for example). A boost in user retention also increases brand loyalty.

- Lowered costs: Gamified apps represent banking on the internet. By moving away from physical institutions, they save banking companies a lot of money in both operating as well as capital expenditure.

- Invaluable customer data insights: Gamified apps can be used to gather a variety of data about banking customers which when analyzed, give banking orgs invaluable insights into their user demographic. Companies can pinpoint their areas of growth and address products that are more catered towards their user base.

- Differentiation from competitors: Incorporating game mechanics in a digital banking app can help it stand out from its competition. Banking gamification is still in its primary stages, so early adopters stand out and gather more traction from users via the enjoyable experience gamified apps provide.

- Potential to draw more customers: Better user retention in gamified banking apps brings in new customers as well. As existing customers are happier, they spread the word: and word-of-mouth advertising generates more buzz than traditional methods, roping in newer customers.

Examples of Gamification in Banking

Financial organizations have already started to introduce gameplay mechanics into their banking products, tapping into the high user interaction potential of gamification techniques. Recent examples include:

- PNC Bank, a US-based financial org, created a Virtual Wallet as a modern solution to incentivize their customers to set up and reach their savings goals. This Virtual Wallet was a hybrid between a checking and a savings account. A feature of this Virtual Wallet was an interactive widget, called Punch the Pig. This appeared as a piggy bank on the bank customer’s screen while using the wallet – nudging the user to transfer money via it to a high-yield savings account.

- In 2015, Emirates NBD, the largest government-owned bank in Dubai and one of the largest financial organizations in the Middle East, launched a fitness app to encourage its users towards a healthy lifestyle. Emirates NBD customers could open a ‘Fitness Account’ – a mobile-based savings account that incentivized customers with higher interest rates on their balances based on their level of physical activity. The fitness account synced up with the NBD fitness app – designed to work on Apple Watch and a list of other fitness trackers – and rewarded users of up to 2% p.a. on their savings based on their step count for the day or distance covered while running. The base interest rate of 0.25% shot up to 0.5% for 5,000 steps, 1% p.a. for 8,000 steps and 2% p.a. for 12,000 steps. This gamification strategy helped bring Emirates NBD $4.37 million in savings.

- CommBank of Australia in 2011 launched a property-simulator game. Dubbed ‘Investorville’, this game lets prospective home buyers go through the process of purchasing and owning a property – choosing from different mortgage products to renovations and experiencing paying property taxes. The game would also show the consequences and pitfalls of the users’ financial investments and decisions.

- Twist and Win from Standard Chartered Bank is another good example of gamification mechanics applied in banking to increase user engagement. Bank customers were eligible to win cashback on their credit card transactions by twisting the levers of a virtual gumball machine that appeared in-app. Standard Chartered saw a noticeable uptick in their customers’ credit card expenditure as a result of this campaign.

- BBVA, the leading Spanish digital bank, launched a game in 2013 to increase customer loyalty and retention. Called ‘BBVA Game’ – this web application encouraged customers to watch tutorial videos about banking, paying taxes, and other financial transactions that they could do via the BBVA banking app. Customers received points for watching videos that they could later spend on a variety of platforms. After 6 months, the game had over 100,000 users and increased BBVA’s user satisfaction rate by 18%.

—

Several aspects of the banking industry benefit from gamification since most of it is heavily user-centric. The traditional banking experience has many steps involved in them that can be easily translated into a gamified app – from learning about banking terminologies, banking services to account maintenance and knowledge about products and purchase decisions. As banks continue to go digital, added online perks like social media collaboration or brownie points redeemable in stores are becoming pivotal in a highly competitive market. Gamification allows seamless integration of milestones and rewards, either via a separate app in the ecosystem or in-app, offering a win-win scenario for both banks and their customers.