“You don’t build a plane and then start flying. You build a plane while you’re flying it. That’s what an entrepreneur does.”

Taro Araya knows a thing or two about building a plane while flying into uncharted skies. A Japanese national born in Colombia, he worked for Swedish telecom infrastructure company Ericsson in Bangladesh, built an agritech startup in Myanmar, and then founded a “Netflix of games” which has notched up 470,000 subscribers in the emerging markets of Asia and Latin America.

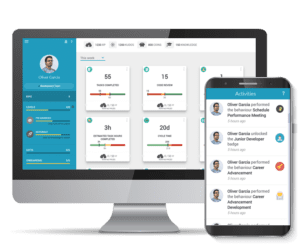

Goama Games, also known as Go|Games, gives subscribers ad-free access to hundreds of top-rated games which would be too expensive to play otherwise. But this is only one part of its business model.

For scaling and monetization, it also has a B2B2C (business-to-business-to-consumer) model. Partners can host games on their apps by embedding Goama. This helps partners raise their engagement with users, while Goama increases its reach and revenue sources. Partnerships also help with payments.

- Subscription-based gaming and e-sports apps have been trying to gain traction in India, especially amid the lockdown

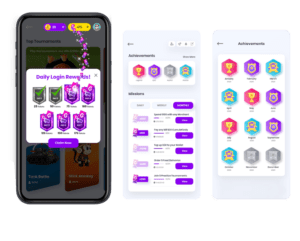

- Goama’s value proposition comes from the 2,000 games in its library, which gives subscribers a rotating list of 400 games

Digital payment apps, telecom companies, and on-demand delivery companies are among Goama’s partners. A new focus area this year has been to enable ‘super apps’ to host casual esports tournaments. It has already signed deals with four super apps and five more are in the pipeline.

Goama’s gaming tournaments crossed 480,000 monthly active users in April. This was also the month when covid-19 lockdowns led to such a surge in traffic that its servers went down, says Araya. While that was a “nice problem” to have, it also interrupted Goama’s search for B2B partners in India to scale up in a country with a massive mobile user base. But it’s live in 16 countries currently in various forms.

Taro, whose father is Japanese and mother Colombian, did part of his schooling in the US before returning to Colombia where he set up a car repair shop while still at college. “My hobby was painting cars and this turned into a company with 22 employees.”

He later joined Ericsson after a short stint with an HR consulting firm from which he got fired. “I can take advice but I’m not the best person to take orders,” explains Taro.

For Ericsson, he worked in Colombia, Panama and Jamaica, before moving to Bangladesh as VP of sales and marketing. He left this “cushy ex-pat job” to launch his first startup, Miaki, with a Bangladeshi partner who funded it. It gave free call time to users for consuming ads from brands, which in turn gave telcos an extra revenue track.

After a wave of terrorist attacks in Bangladesh in 2015 and 2016, Araya shifted to Myanmar. There he spun out an agritech startup, Village Link, that provided information, services and products to farmers. But he found it hard to crack monetization and eventually diluted his stake in that too.

Around that time, he roped in Wayne Kennedy as a co-founder. Kennedy had quit his job as director with Myanmar telco Ooredoo. The plan was to acquire a value-added services business in Myanmar, but it didn’t pan out.

Then they took the plunge into subscription gaming in 2017. “We piggybacked on my other organizations which had connections in the region for telcos. That’s how we started doing monetization. And suddenly it took off,” says Araya, who has moved to Singapore now.

Goama raised funding last year from global VC fund SOSV as part of its Taiwan-based Mobile Only Accelerator (MOX). William Bao Bean, the general partner at SOSV, likes Goama’s business model. It’s a smart play where the B2C subscriptions provide validation and keep the engine running while the B2B model is built up.

“You’ve got to find a business model and charging model that makes sense for the market. Just because something works in the US doesn’t mean it’s going to work in Asia, especially for low to medium-income consumers,” says Bao Bean.

Subscription-based gaming and esports apps have been jostling with one another to gain traction in India, especially after the COVID lockdowns. Amazon has just made gaming available at no extra cost to Prime members, albeit with a limited selection. Bengaluru-based Mobile Premier League focuses on esports along with access to about 40 games.

Goama’s value proposition comes from the 2,000 games in its library, which gives subscribers a rotating list of 400 games. It’s also far more affordable than ‘game passes’ from the likes of Microsoft, Apple, and Sony. The monthly price of a PlayStation Plus subscription dropped to Rs. 499 recently, but that’s still steep for a mass-market consumer.

Araya hopes that the association with Bao Bean will help him scale his venture to heights he’s yet to experience as a serial entrepreneur. Coincidentally, after the deal was signed with SOSV, he and Bao Bean discovered they went to the same high school in the US. It’s a small world.

credits: MINT[/vc_column_text][stm_spacer height=”40″][/vc_column][/vc_row]